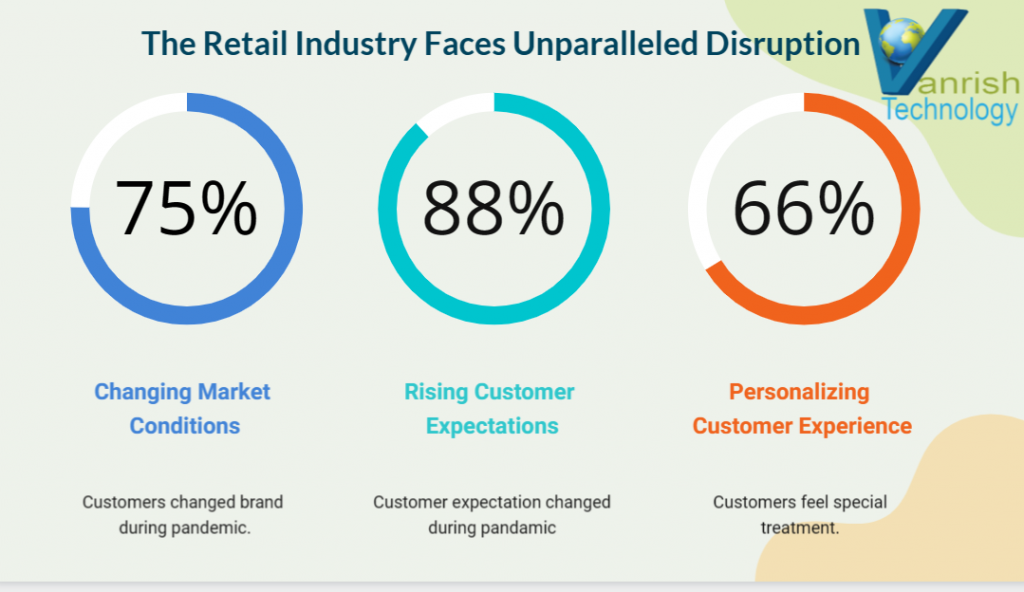

From the last few years COVID pandemic has changed the whole Retail business spectrum in ways we could have never imagined before. Exploring new and accelerated trends gives us an indication of how this evolution will continue into the new normal. This pandemic also leads to closure of countless stores and bankruptcy. After surviving from the pandemic, inflation is hard hitting Retail business. Supply chain is also getting impacted with the Russia-Ukraine war. Now experts are saying that the greatest risk facing global supply chains has shifted from the pandemic to the Russia-Ukraine military conflict and the geopolitical and economic uncertainties.

With all this news for Retail industries, customer expectations and habits have shifted. Customers expect engagement on values to go beyond point of purchase to creating moments of engagement across the full journey. Now retailers have been compelled to find new ways to connect with consumers in a personalized and tailored way in-store as well as online to make a more intuitive experience. Retailers are going more digitized in their approach to connect with customers.

This is how retailers are moving forward to reach a wider customer base and lure their product.

- e-commerce Technologies – In pandemic time if your business presence was not online then you will be out of business quickly. So Retailers have increased investment in e-commerce technologies. They increased the budget for digital transformation. To get ahead of competition, they are offering a mix of digital and physical experiences ahead of their rivals. Retailers are also focusing on customer service and providing seamless service experience across messaging, web and mobile channels. Retailers are creating a cohesive and connected customer shopping journey with e-commerce and unified data across systems.

- Infrastructure– Retailers are upgrading their instore as well as online infrastructure. They are replacing traditional store signs with digital signs and screens to display ads and videos. They are also adding kiosks and self-checkouts within the store. This is making the shopping experience more convenient and personalized. Shoppers are in and out, without having to make small talk or wait in queues. Deployment of in-store technologies double in a year.

- API-first and Cloud – Retailers are focused on Composable architecture. Composable architectures are key players to implement successful digital transformations and most engaging digital experiences. 2023 will be a year of focus for retailers to remove entirely their legacy monolithic architectures. API-first and Cloud based solutions help retailers to switch to new functionality without the need for significant investment and resources. This will reduce the incredible amount of time and cost of ownership of a fraction of legacy technologies. API-first connectivity helps customers to shop anytime, anywhere and anyhow.

- Customer experience – Customer experience is the one the main focus for Retailers this year. The focus of customer experience is online as well as in store experience. Retailers are providing customers enhanced assisted-selling experiences through assisted Selling. They are also focusing online customers through distributed OMS (Order Management System), Omni-channel and remote Selling. Retails are preparing for next level customer experience through loyalty(customers long-term relationships), native App and AI based digital fitting room.

- Merchandising & Supply Chain – Retailers are providing real time tracking and inventory information to their customers. They are also providing purchase incentives to their loyal customers so that they can keep engaging customers for their products. Retailers are also focusing on upgradation of warehouse management (WMS) to fulfill in-store as well as online orders.

Rajnish Kumar, the CTO of Vanrish Technology, brings over 25 years of experience across various industries and technologies. He has been recognized with the “AI Advocate and MuleSoft Community Influencer Award” from the Salesforce/MuleSoft Community, showcasing his dedication to advancing technology. Rajnish is actively involved as a MuleSoft Mentor/Meetup leader, demonstrating his commitment to sharing knowledge and fostering growth in the tech community.

His passion for innovation shines through in his work, particularly in cutting-edge areas such as APIs, the Internet Of Things (IOT), Artificial Intelligence (AI) ecosystem, and Cybersecurity. Rajnish actively engages with audiences on platforms like Salesforce Dreamforce, World Tour, Podcasts, and other avenues, where he shares his insights and expertise to assist customers on their digital transformation journey.