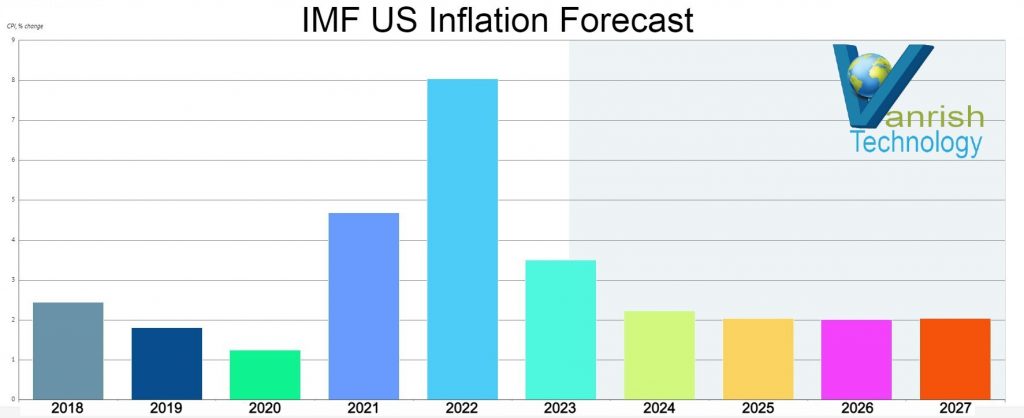

Global uncertainties continue to dominate headlines. Inflation is expected to reach the highest levels of ~3.5% in the US and Europe by the end of 2023. To ease inflation, Central Banks need to dampen demand, by making it expensive (for financial institutions, businesses and households) to borrow by increasing Federal Reserve interest rates . We are expecting a federal rate hike of 4.75% – 5.0% by the end of 2023. These are all data showing we are heading toward recession. The US labor market was robust last quarter but this quarter it is not very promising. Everyday we are hearing layoff news from different sectors.

These inflation and layoff news are impacting our tech market. Many companies have a growth challenge: They expect to get as much as 50 percent of their revenue from new businesses and products by 2026 but are not on a path that will take them there. Current economic conditions are forcing high-growth yet unprofitable tech startups to tighten their financial belts.

There are few realities, software companies are facing for their growth.

US-based Venture capitalists backed software startups slowed down – VC are very clear of high valuation and demanding that companies spend less, improve profit margin and high output. Unicorn creation also slowed in 2022 Q4. This is one of the lowest quarterly count since the first quarter of 2020.

Depressed company valuations – Private company valuations are cooling down. Over the last 4 quarters, we have seen public valuations compressing.

Software companies have three critical revenue streams.

- License / Subscription Revenue – When the customer pays for the right to own and use a copy of the software/hardware product or subscribe/access software platform

- software or hardware product – Customer pays for ongoing support or premium support.

- Cloud based licensed software – Customer pays the software provider for specific deliverables such as software implementation or technical training.

In the current world all these 3 revenue streams are shrinking. Companies are using only essential services to run their business. This is directly impacting software revenue, which is leading these companies into low valuation.

Infrastructure Maintenance – SaaS companies are providing the software as a service. This means the customer does not have to purchase hardware to run the software—that cost is transferred to the SaaS provider. This is implying continuous software running coast. This cost is not going anywhere.So due to inflation this SaaS running cost increases tremendously.

Rajnish Kumar is CTO of Vanrish Technology with Over 25 years experience in different industries and technology. He is very passionate about innovation and latest technology like APIs, IOT (Internet Of Things), Artificial Intelligence (AI) ecosystem and Cybersecurity. He present his idea in different platforms and help customer to their digital transformation journey.